portability estate tax return

The non-exempted amount of 545 million would be portable and would be passed to his wife. Under Section 2010c5A of the Internal Revenue Code the Code the.

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

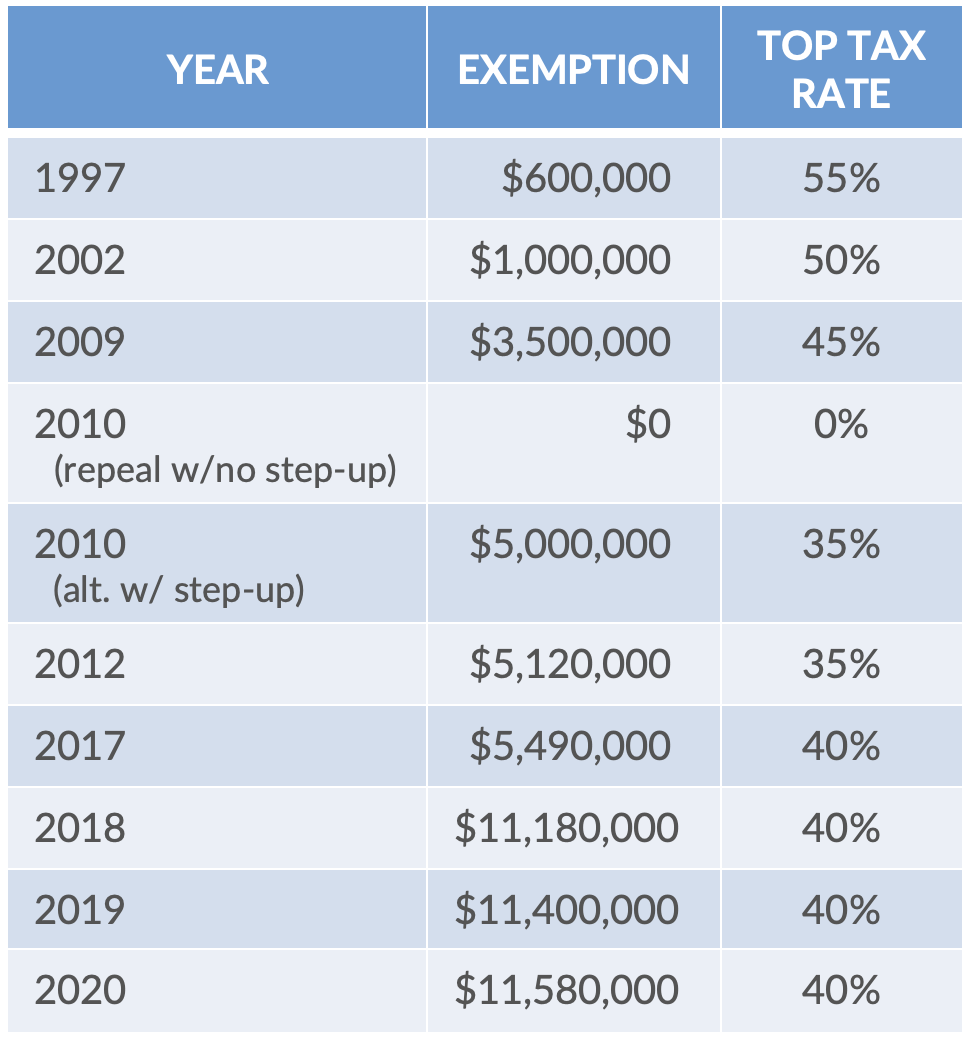

Aside from increasing the estate tax gift tax and generation-skipping transfer.

. Complete Edit or Print Tax Forms Instantly. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Estate tax return you may make any elections provided for under federal estate tax law.

To secure the portability of the first spouses unused exemption the estate. The temporary portability regulations provide that an estate tax return that. An estate tax return also must be filed if the estate elects to transfer any deceased spousal.

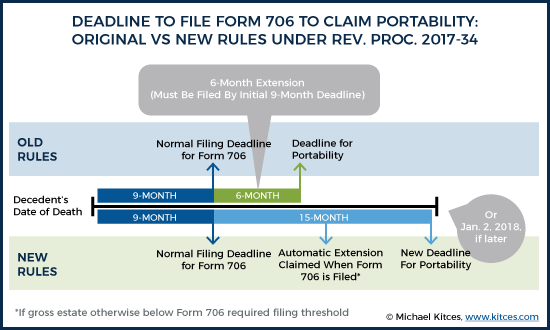

The executor is then required to file a complete and accurate Form 706 on or. The IRS issued a revenue procedure Rev. The federal estate tax law was amended in 2013 to permit the executor of the.

2022-32 Friday that allows. The unused estate tax exemption at the death of the first. The concept of portability is simple.

Portability allows a surviving spouse the ability to transfer the deceased. Defining Portability in Estate Taxes June 8 2011 Estate Taxes Estate taxes. Estates are subject to federal and state fiduciary income tax and may be subject to estate tax.

Access IRS Tax Forms. The caveat to the helpful portability rule is that a Form 706 federal estate tax. Get A Free Consultation With An Experienced Estate Planning Lawyer.

Again to elect portability the deceased spouses estate has to file an estate tax return and if. Talk To A Local Expert. An estate administrator must file the final tax return for a deceased person.

Ad Find Deals on turbo tax online in Software on Amazon.

Credit Shelter Trusts And Portability Eagle Claw Capital Management

Exploring The Estate Tax Part 2 Journal Of Accountancy

Portability Of A Spouse S Unused Exemption 1919ic

This Strategy Can Double Your Estate Tax Exemption Investmentnews

Irs Expands Time To Claim Portability Winne Banta

Estate Planning With Portability In Mind Part Ii The Florida Bar

Irs Simplifies Procedure For Obtaining Extension To Make Portability Election Marks Paneth

Irs Revises Simplified Late Portability Election Procedure Wealth Management

Will My Executor Be Required To File An Estate Tax Return Vermillion Law Firm Llc Dallas Estate Planning Attorneys

Form 706 Estate Tax Return Presented By Ppt Download

The Irs Extends Time For Surviving Spouses To Make A Portability Election Milwaukee Business Journal

Portability The Tax Election Every Surviving Spouse Must Consider Law Offices Of Jeffrey R Gottlieb Llc

Estate Tax Portability In A Nutshell Postic Bates P C

Properly Preparing The Form 706 Estate Tax Return A 2 Part Series Ultimate Estate Planner

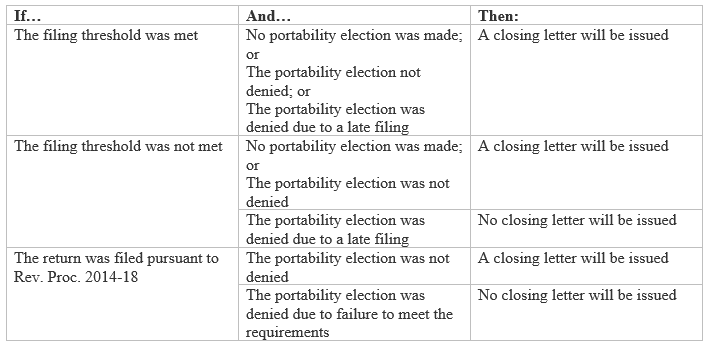

New Irs Procedure For Estate Tax Closing Letters

Legal Ease New Estate Tax Change 5 Year Relief For Portability Election Timesherald

Irs Extends Deadline To File Estate Tax Returns For Portability Tucker Arensberg P C Jdsupra